Browsing E2 Visa Requirements: Important Information for Business Investors

Guiding with the requirements for an E2 visa can be a complicated procedure for business financiers. Comprehending the qualification criteria, investment expectations, and required paperwork is crucial. Each aspect plays a significant role in the success of the application. Without careful prep work, applicants might deal with unexpected obstacles. What certain actions should capitalists prioritize to improve their chances of authorization?

Understanding the E2 Visa Summary

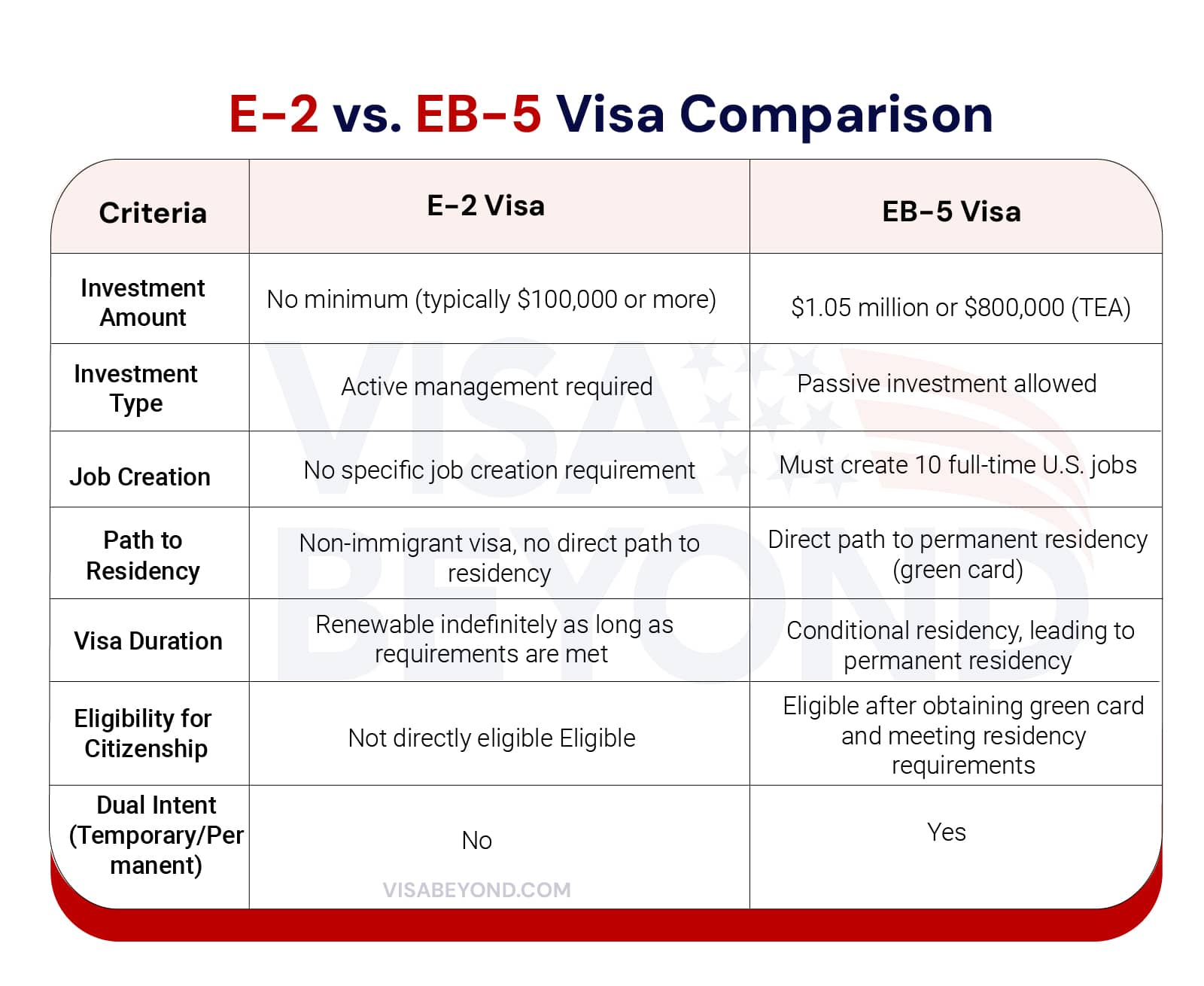

While lots of visa options exist for international capitalists, the E2 Visa stands apart as a feasible path for those seeking to establish or spend in an organization in the United States. This non-immigrant visa is made especially for residents of countries that have a treaty of business and navigation with the united state. The E2 Visa allows capitalists to develop and guide the procedures of a business, offered they satisfy certain financial investment limits.

One of the vital advantages of the E2 Visa is its versatility, allowing capitalists to engage in a wide array of business activities. In addition, it can cause the opportunity of expanding the visa status forever, as long as business continues to be operational and meets the visa requirements. E2 visa requirements. Generally, the E2 Visa acts as an attractive option for foreign entrepreneurs looking for to capitalize on the durable U.S. market

Qualification Criteria for E2 Visa Applicants

To get an E2 Visa, applicants have to fulfill a number of vital requirements that show their dedication to investing in a united state business. The applicant needs to be a national of a nation that has a certifying treaty with the United States. This treaty country standing is essential, as it develops the candidate's eligibility for the E2 Visa.

Additionally, the candidate should show that they are actively investing or preparing to spend a significant quantity of funding in a bona fide enterprise. This financial investment should not be minimal, suggesting it should generate even more than adequate revenue to support the capitalist and their family members.

Moreover, applicants should have the ability to direct and establish business, guaranteeing they play an active role in its operations. Finally, the applicant has to show that their investment will produce task chances for U.S. employees, adding to the economic climate.

Investment Requirements for E2 Visa

Investment requirements for the E2 Visa are vital in identifying the practicality of a candidate's business venture in the USA. To certify, the financial investment should be considerable, generally comprehended as a considerable section of the complete cost required to develop the venture. While there is no fixed dollar amount, financial investments usually begin around $100,000, depending upon the nature of business. The funds need to be at risk and dedicated to business, meaning they should not be sitting idle or conveniently recoverable.

In addition, the investment must be in an actual and running business, not a passive financial investment. This implies business needs to be actively taken part in commercial activities that create profit. Applicants must likewise demonstrate that their investment will develop jobs for united state workers. As a result, cautious planning and documents of the investment are vital for a successful E2 Visa.

Qualifying Organizations for E2 Visa

The E2 visa program requires that applicants buy organizations that meet particular requirements. Eligible business kinds can vary from retail establishments to solution sectors, each with its own investment quantity requirements. Comprehending these credentials is crucial for possible capitalists seeking to safeguard an E2 visa.

Eligible Business Types

Qualifying services for the E2 visa need to satisfy details requirements that show their possible for success and economic influence. Eligible business types usually include small to medium-sized business in different fields, such as retail, manufacturing, modern technology, and friendliness. These businesses must be actively operating and not merely passive financial investments. Service-oriented services, such as consulting and medical care, are likewise thought about eligible. Nonetheless, business must supply a tangible service or product that adds to the U.S. economic situation. In addition, businesses that develop task opportunities for united state employees boost their qualification. It is vital for capitalists to assure their picked business type lines up with the E2 visa requirements to promote an effective application process.

Financial Investment Amount Requirements

Determining the ideal financial investment quantity is an essential aspect of the E2 visa process for business investors. The U.S. federal government does not specify a minimal financial investment quantity; however, it needs to be significant in regard to the business's total value - E2 visa requirements. Typically, investments ranging from $100,000 to $200,000 are thought about sensible for many applicants. The amount has to be adequate to establish and operate the business efficiently. Furthermore, the financial investment should show a genuine dedication to the enterprise, with funds in danger in the industrial endeavor. It is necessary for financiers to present a clear click for source business strategy that outlines the use of these funds, detailing just how they will sustain business's functional needs and growth possibility

Application Process Steps for E2 Visa

The application process for an E2 visa entails a number of essential actions that financiers should very carefully browse. This consists of a review of qualification requirements, thorough paper preparation, and understandings right into the interview procedure. Comprehending each component is necessary for an effective application result.

Qualification Standard Summary

Qualification for the E2 visa rests on certain requirements that possible business financiers have to satisfy. Applicants should be residents of a treaty country that has a financial investment treaty with the United States. In addition, they should demonstrate a considerable financial investment in an U.S. business, which is typically taken a substantial amount relative to the total cost of acquiring or establishing the enterprise. The financial investment needs to also go to danger, suggesting it undergoes potential loss. In addition, business should be an authentic venture, proactively participated in commercial activities, and not just a passive investment. Lastly, the financier has to intend to create and great site route the business, guaranteeing their energetic involvement in its operations.

Document Prep Work Fundamentals

Steering with the application procedure for an E2 visa requires cautious attention to document preparation. Applicants should gather essential documentation to demonstrate qualification, consisting of evidence of financial investment and business viability. Trick documents typically consist of a thorough business strategy outlining the business's objectives, market evaluation, and financial projections. In addition, evidence of the resource of mutual fund is essential, as it needs to show that the money was acquired legitimately. Sustaining monetary records such as financial institution statements, income tax return, and monetary statements of the business are additionally necessary. Applicants need to compile personal identification papers, including passports and resumes. Detailed organization and clarity in providing these records can substantially improve the opportunities of a successful E2 visa.

Meeting Process Insights

Exactly how does the interview process for an E2 visa unravel? The meeting is an essential component of the application process, normally carried out at an U.S. consular office or embassy. Applicants need to get here ready with their documentation, consisting of the business plan, investment information, and evidence of citizenship. Throughout the meeting, consular police officers analyze the applicant's qualification, concentrating on the authenticity of the business and the financial investment's capacity. Inquiries might cover the candidate's history, business operations, and economic projections. It is crucial for applicants to demonstrate their commitment to the venture and understanding of U.S. business methods. A successful meeting can considerably influence the result, making prep work and clarity in interaction paramount for potential investors looking for E2 visa authorization.

Common Obstacles and Exactly How to Get over Them

Steering via the E2 visa procedure can provide different challenges for business investors, specifically when it concerns conference particular requirements and recognizing lawful nuances. One typical challenge is showing that the financial investment is not limited and significant. Financiers should supply detailed economic documents, which can be daunting without prior experience in U.S. laws.

An additional obstacle is ensuring business plan satisfies the visa criteria. Financiers commonly battle to verbalize a detailed strategy that lays out job production and financial effect. Additionally, navigating with go right here the complexities of migration law can be overwhelming, resulting in prospective hold-ups or denials.

To get over these obstacles, looking for guidance from immigration lawyers that focus on E2 visas is a good idea. They can provide vital insights right into the documentation required and help improve business strategies. Additionally, engaging with local business networks can use assistance and resources that alleviate the process, making the course to safeguarding an E2 visa a lot more manageable.

Tips for a Successful E2 Visa

Steering the E2 visa process requires cautious preparation and interest to detail. Possible applicants need to start by thoroughly looking into the requirements details to their nationality and desired financial investment. Developing a detailed business plan that details the nature of the financial investment, functional techniques, and projected economic efficiency is necessary. This plan works as an important tool to demonstrate the practicality and possible success of business.

Applicants need to also collect all essential documentation, consisting of evidence of investment funds and evidence of the business's energetic procedure. Guaranteeing the accuracy and completeness of all sent materials is important, as any discrepancies can cause rejections or delays.

In addition, applicants must plan for the visa meeting by practicing responses to prospective concerns regarding their business and investment. Engaging a migration lawyer with experience in E2 visas can provide useful support throughout the procedure, enhancing the probability of a successful application.

Frequently Asked Inquiries

Can I Benefit a Various Employer on an E2 Visa?

A person on an E2 visa can not benefit a different company. The visa is employer-specific, allowing job just for the funding business. Any type of adjustment in work requires a brand-new visa or modification.

Exactly how Long Does the E2 Visa Process Normally Take?

The E2 visa procedure commonly takes between two to 4 months. Variables such as the applicant's race, the complexity of the business strategy, and the processing times at the particular consular office can affect period.

Can Household Members Accompany Me on an E2 Visa?

Yes, household participants can accompany a private on an E2 visa. Partners and kids under 21 are eligible to request derivative visas, permitting them to live and examine in the USA.

What Takes place if My E2 Business Stops Working?

If an E2 business fails, the visa owner might face obstacles, consisting of possible visa retraction and the failure to continue to be in the united state. They need to explore alternative options or look for legal recommendations for their circumstance.

Are There Particular Tax Implications for E2 Visa Holders?

E2 visa owners might encounter certain tax obligation effects, including possible taxation on worldwide revenue, relying on their residency status. Consulting a tax obligation professional is advised to recognize responsibilities and maximize tax approaches efficiently.

While many visa options exist for foreign investors, the E2 Visa stands out as a feasible pathway for those looking to spend or develop in a service in the United States. In addition, it can lead to the opportunity of extending the visa condition indefinitely, as long as the business continues to be operational and meets the visa requirements. Investment requirements for the E2 Visa are crucial in figuring out the stability of an applicant's business endeavor in the United States. Identifying the proper investment amount is an essential aspect of the E2 visa procedure for business capitalists. If an E2 business fails, the visa holder may face challenges, including possible visa revocation and the lack of ability to continue to be in the United state.